At the Jobtech Alliance, we’ve been working with platform partners across Africa to build one of the continent’s largest datasets on gig worker earnings. Beyond headline averages and aggregated impact numbers, this data lets us dig deeper into the real income patterns of gig workers. We can now segment gig workers into earning profiles—helping us understand who is thriving, who is just getting by, and who risks being left behind. In doing so, we can meaningfully work with platforms to drive engagement and inclusivity.

This blog complements our recent learning study into what we call ‘micro-earners’ i.e. platform users earning $20 per month or less. It explains our data on the distribution of earnings on jobtech platforms in Africa.

Micro-earners are the majority

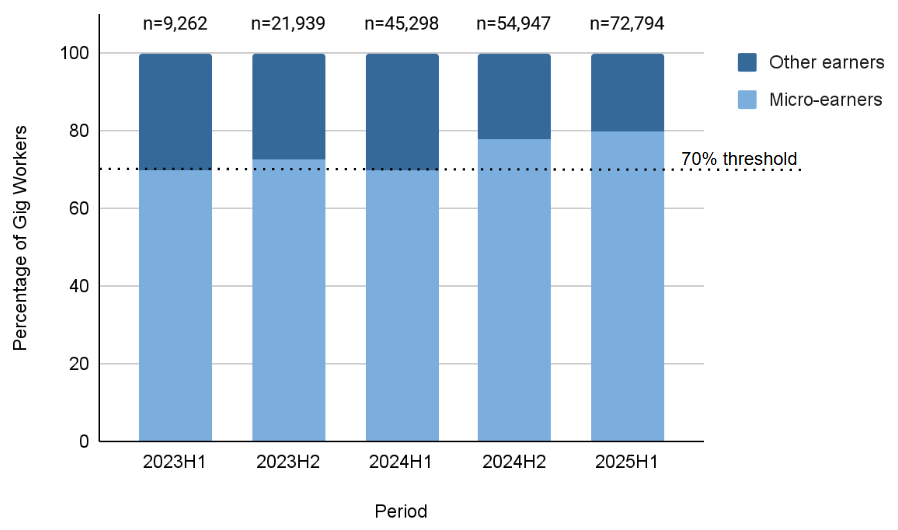

The data shows that, across all gig-based platforms on our earnings database, more than 70% of all gig workers are micro-earners. That’s not a one-off snapshot; it holds steady across time (30 months) and sample size (9,000-72,000). Whether we looked at 9,000 gig workers in the first half of 2023 or 72,000 in the first half of 2025, the trend was the same. Most people on gig platforms are micro-earners.

Figure 1: Share of micro-earners among all gig workers over time

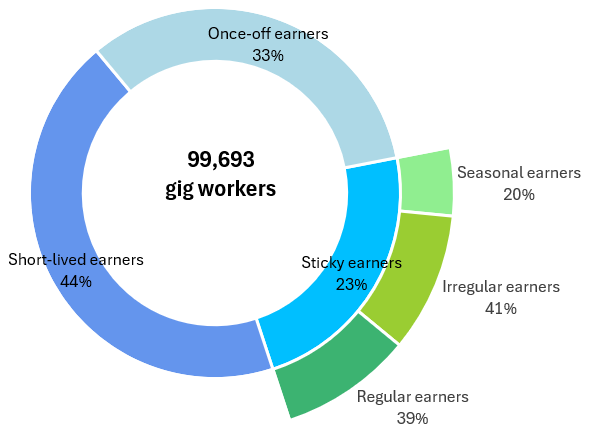

When we looked at the longitudinal data, we saw three distinct earning patterns for gig workers:

- Once-off earners, who earned for a single month and never returned. Among 99,000 workers who joined before the first half of 2025—with at least six months of observable activity between 2020 and 2024—one-third were once-off earners. Their median monthly earning was just $3. Many of these workers likely joined during a recruitment drive, tested the platform, and then left—perhaps because of a lack of demand, poor fit, or barriers to participation.

- Short-lived earners, who earned sporadically for less than a year. The largest share (44%) of gig workers were short-lived earners, dipping in and out of platform work over a period of less than a year, without establishing a stable earning pattern.

- Sticky earners, who had income recorded over 12 months or more. Only 23% of workers belong to this category. But even within this group, earning stability did not appear guaranteed:

- 39% were regular, earning something in every quarter.

- 20% were seasonal, concentrating at least 75% of their earnings in a single quarter.

- 41% were irregular, with at least two quarters of zero earnings despite remaining on the platform.

Figure 2: Gig worker earning frequency

The micro-earner phenomenon is interesting, but not surprising

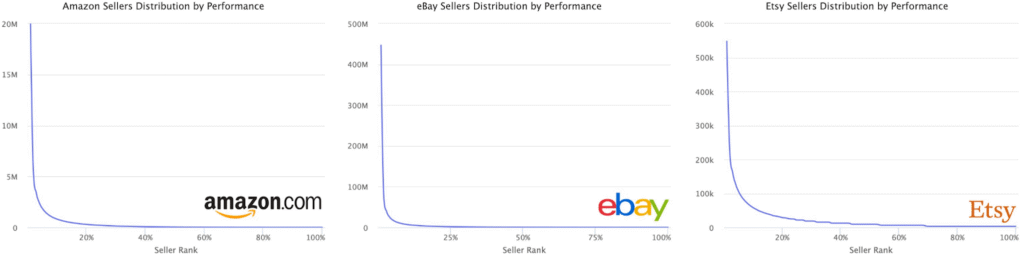

This data above should not come as a surprise to most people working with marketplace-type platforms. For example, 1% of sellers on Ebay in the US receive over 60% of reviews. 91% of App Revenue on Apple’s App Store and Google’s Play Store go to 1% of publishers. On AirBnB, over 50% of revenue goes to 10% of hosts. Even in offline convenience stores in the US, the top 25% of customers account for 80% of sales. This power law is common across many marketplaces:

Source: Marketplace Pulse

Yet in the jobtech sector in Africa, this phenomenon is often not only unexpected, but more problematically—unrecognised. This dominant group can easily become hidden in plain sight. Many platforms primarily consider the average (mean) income per earner, which can mask how most people are performing; a small cluster of high earners can skew the average dramatically, painting a misleading picture of platform impact. For example, averaging monthly earnings across 136,224 gig workers on the earnings database arrives at ~$102 per month using the mean value, but only ~$6 per month using the median one.

This phenomenon is not entirely due to power laws. It can be because of platform model, business performance, or indeed user choice. While marketplaces do typically demonstrate such engagement distributions, other jobtech business models may benefit from having a wide distribution of low-earning users.

Moreover, as our learning study explains, gig workers can be micro-earners by both choice and circumstance. Some are willing micro-earners who use the platforms as a flexible, low-pressure way to supplement a primary income or build a portfolio of work. Others are unwilling micro-earners who struggle to earn more due to a lack of consistent work opportunities, limited demand in their area, or a lack of skills and support to move up.

Designing for micro-earners is key to a fairer, more resilient gig economy

At the Jobtech Alliance, we focus on what we call quality jobs. That is why, historically, we have only focused our interest and attention on sticky earners. But we have recently been pushed to consider what the ‘long tail’ of jobtech users in Africa really looks like. Our data demonstrates that micro-earners are not just a peculiar facet of African gig platforms—they are their backbone.

Acknowledging how low incomes are in the informal economy across Africa, and how most young people maintain a diverse portfolio of work, we recognise that these small amounts of money could be contributing to individuals’ livelihoods in different ways. The research did find that, while the earnings of micro-earners may be small, they are still meaningful, providing a valuable source of income which contributes to individuals’ daily expenses, emergency savings, or wider portfolios of work.

In our learning study, we dive deeper into the lives of these micro-earners, understanding who they are, why they earn what they do, and how they move in and out of platform participation. Rather than dismissing micro-earners as a ‘long tail’ of users, we explore how platforms can strategically incorporate micro-earners into their business models. Because acknowledging micro-earners isn’t optional if we want a gig economy that works for everyone. Considering whether and how to incorporate their goals and needs in platform business models is essential.

0 Comments