By Josh War

The digitization of small business in Africa is a trend that has been rapidly growing in recent years. A study by Mastercard and the International Finance Corporation found that 93% of small businesses in Sub-Saharan Africa have digitized at least one aspect of their business operations. With the rise of technology, many small businesses are turning to digital tools and platforms to streamline their operations and reach a wider customer base.

Small business in Africa is big business – Africa has produced over 44 million SMEs, and in markets like Nigeria and Kenya, informal retail accounts for over two-thirds of the total retail market.

There are three big advantages of digitalization for small businesses in Africa:

(1) Increased efficiency and reduced costs. By automating routine tasks, such as scheduling appointments, sending invoices, and processing payments, small businesses can save time and reduce the risk of human error. This leaves more time for business owners and employees to focus on delivering high-quality services to customers. Digital platforms can also increase access to supply chain, reducing costs and building efficiencies.

(2) Improved sales. Social media and purpose-built digital platforms enable businesses to reach a wider pool of customers, outside of their immediate geographies, sometimes outside of their entire countries. This can also enable small businesses to reach higher paying customers.

(3) Access to finance. Through digitizing sales, records, and/or supply chain, traditionally informal microenterprises without ‘historically viable’ data points for credit scoring are now able to gain access to a range of financial services, from inventory financing to growth loans.

Every mom and pop shop in Africa is being digitalized

Today digitalization in mom and pop shops in Africa is being driven by a number of factors, including changing consumer behavior, the increasing availability of affordable digital technologies, the rise of e-commerce platforms and ofcourse venture capital pumping into the sector. Sayo Folawiyo termed this as the “retail SME rush”, which gave rise to the likes of Twiga, Wasoko, Trade Depot, MarketForce, and Sabi.

Briter Intelligence reports that over $490m was raised by 28 B2B commerce startups between 2009 and 2022, with over 90% coming between 2021 & 2022 alone. Wasoko raised $125m in 2022, Alerzo raised $10.5m in 2021, Sabi raised $20m in 2022, Marketforce360 raised $40 Million in 2022. These platforms help small retail businesses to connect with customers and manage their operations offering business management, supply chain, financing and customer management solutions. As one 2021 Techcrunch article called out, “The process of digitizing the operations of mom and pop stores in Nigeria is serious business right now. In fact, it might be the second-best thing after fintech at the moment.”

While the FMCG retail space is becoming thoroughly digitized, what is happening in other small business sectors?

Wait!! We are digitizing every other microenterprise?

In our earlier article What do jobtech platforms do if there are no jobs?, we forecast the rise in ‘vertically integrated platforms’ in Africa – platforms which provide a full suite of the infrastructure and tools for entrepreneurs to earn a livelihood. In this way they function almost as an ‘e-commerce engine’ specific to a sector. While the first generation of jobtech in Africa was built as gigmatching platforms – centrally aggregating and productizing services and matching the providers to buyers – a second wave of platforms is providing the infrastructure (business management tools, supply chain, market access) for service providers to succeed on their own. Sayo Folawiyo described this shift with South African home services marketplace, Kandua, as a shift from gigmatching to building ‘HustleOs’ for the service provider.

While there’s still a lot to learn within this space we have already seen a number of platforms emerging as such ‘vertically integrated platforms’ within the verticals below:

- Home services (Kandua, providing business management tools, customer discovery, for home service providers)

- Creative industries (HustleSasa, providing digital storefronts, order management, payments and delivery. They help creators sell directly to their audience)

- Clothing (Fitted, providing AI-enabled platform that allows fashion customers, tailors and fabric sellers collaborate to produce exceptional quality outfits on time )

- Beauty (Ricive, providing faster check-outs for walk in customers and turning inventory into and e-commerce store allowing merchants easily manage suppliers and staff, deliver to customers with no logistics setup)

- Restaurants (Orda, providing the operating system to power food businesses, Food business owners can Process orders, accept payments, connect to logistic providers, engage customers all in one app)

- Non-FMCG retail (Trustwave, providing merchants business management tools to keep records of customers, sales, and products, all from a mobile phone.)

- Tutoring (Klas, providing a simplified platform that allows anyone teach online)

Digitization of everything. So what, and how does this lead to improved livelihoods?

Small convenience stores in Nigeria have struggled to compete with larger retailers in the past. However, with the introduction of technology solutions such as a simple mobile app, store owners are able to track inventory, process payments and place orders for new stock/products offering better and improved services to customers and increasing sales. Technology has the potential to help level the playing field for even the smallest businesses in Africa.

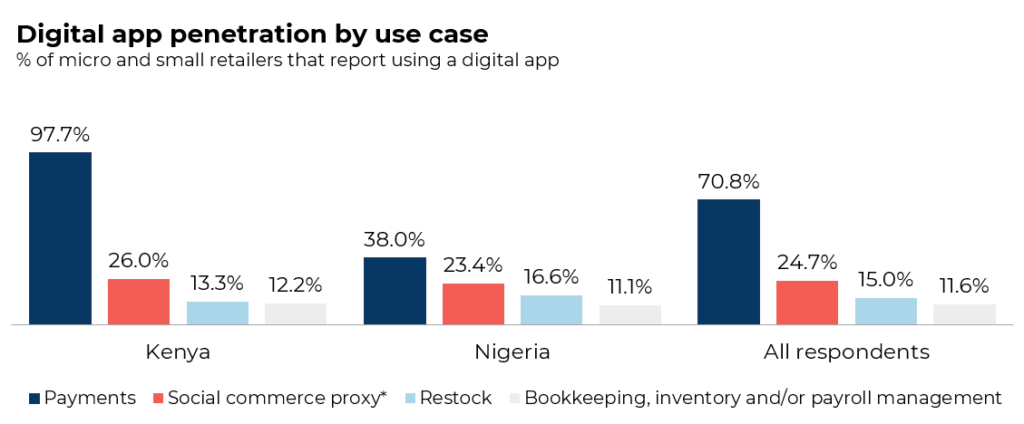

Does digitizing small businesses lead to improved livelihoods for users of these platforms? The information that is currently available suggests so. Research by Caribou Digital, for example, found that SMEs in Kenya who use more digital platforms were twice as likely to report their business as being in good health compared to those using less digital platforms. But more information is needed. Particularly as greater diversity is emerging in ‘the digitalization of the SME’ in Africa, which of the above models will achieve greater livelihood outcomes for users?

At the Jobtech Alliance, we are seeking to learn more about this space, and are excited to be working with companies like Fitted (Nigeria) and Jemla (Ethiopia) in our acceleration activities, who are digitizing micro-enterprises in different ways. We’ll come back in a few months with some of our learnings.

The author is a Senior Venture Building Manager at the Jobtech Alliance.

Some really good points made here. I think we have barely scratched the surface when it comes to the competitive advantages that tech can provide for microenterprises.